What Middle Powers—and Small Businesses—Can Learn About Power in an Age of Integration

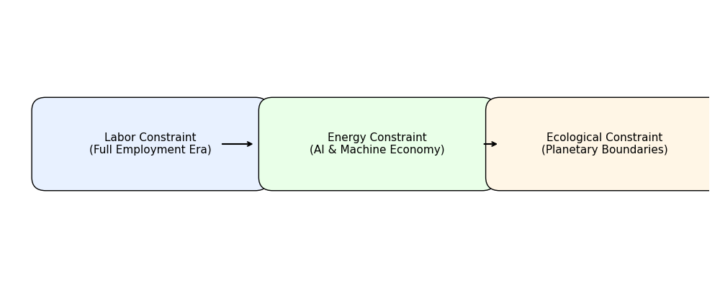

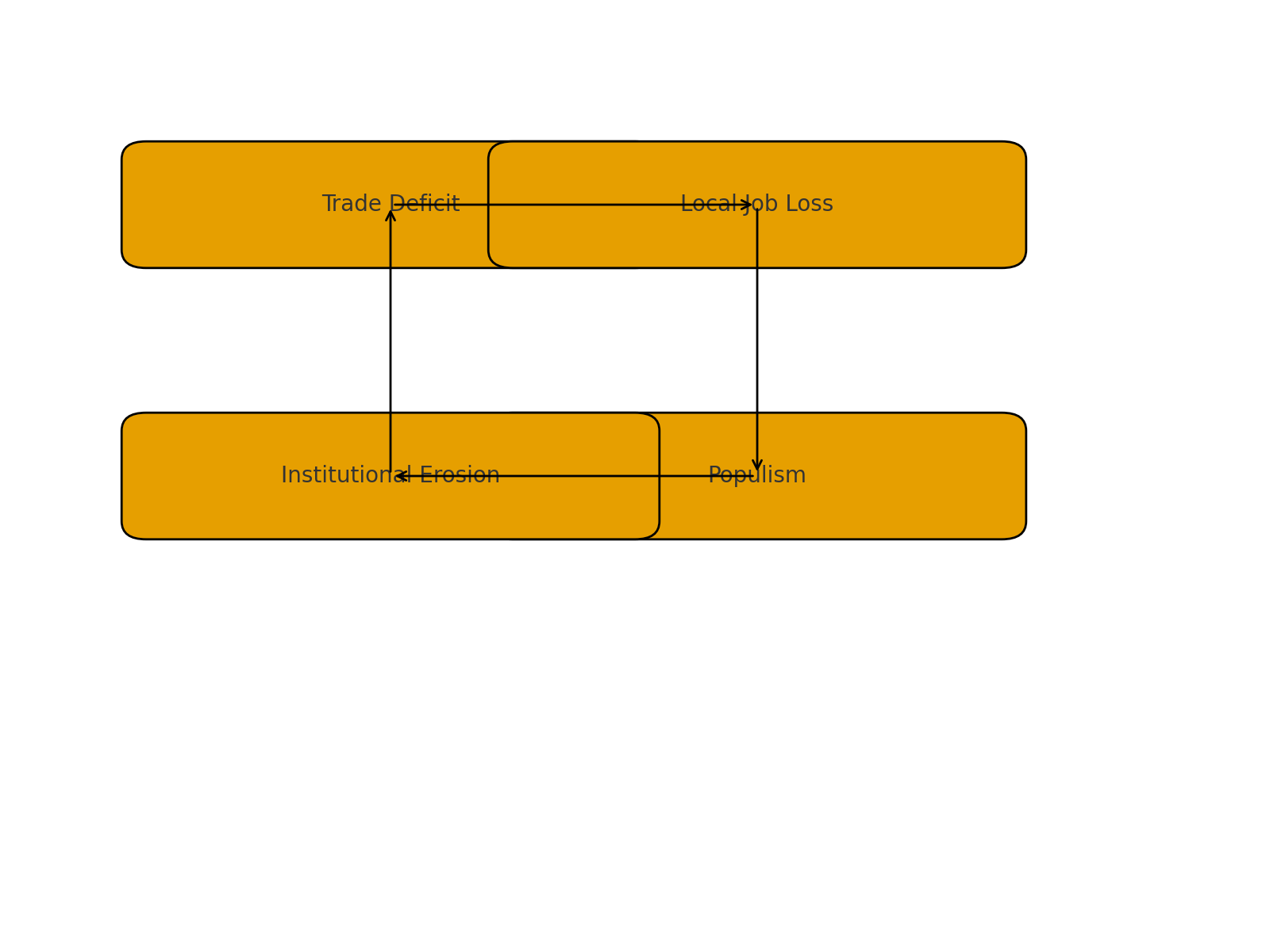

The world is clearly becoming more connected. Supply chains now span the globe, money moves instantly, and digital platforms link millions of buyers and sellers. But instead of spreading power, these systems are concentrating it. What was once seen as a way for everyone to benefit is now often felt as a way to control.

Recently, at the World Economic Forum in Davos, Mark Carney, Canada’s prime minister, gave a thoughtful analysis of this situation. (**Speech reprinted at the bottom of this post.) While he spoke in terms of geopolitics, his points also apply to the digital economy, especially the rise of powerful platforms, sometimes called digital feudalism.

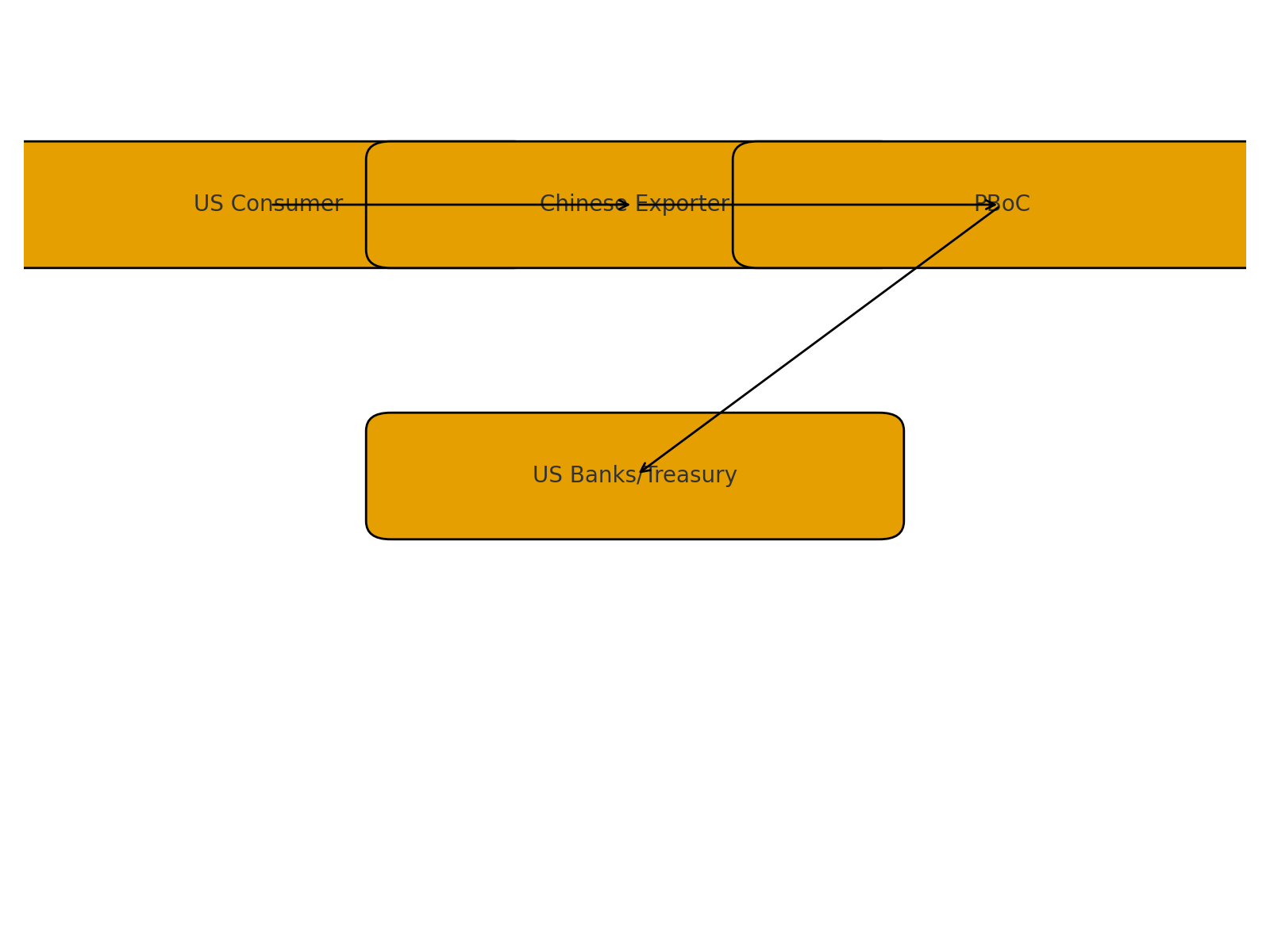

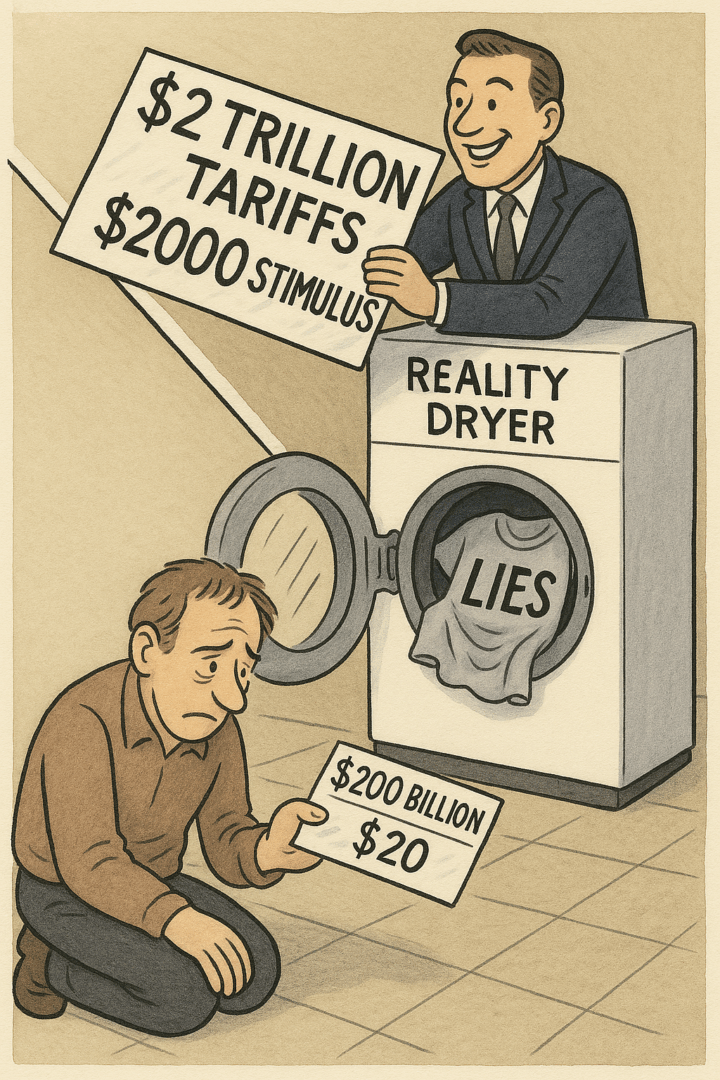

Carney’s speech does more than just describe a world in crisis. It points to a bigger idea: that power in connected systems is often one-sided. The way platforms are built shows this clearly. For example, they collect vast amounts of data on markets and businesses but don’t share much in return. They also use pricing tools to change fees and costs, helping themselves while leaving smaller businesses with little say. Seeing how these systems work helps explain why powerful states and many companies act the way they do under big digital platforms like Amazon.

When Integration Becomes a Weapon

For many years, countries like Canada did well under the “rules-based international order.” This system was imperfect and not always fair, but it provided stability in trade, safe shipping routes, and economic security. Being part of it brought benefits, even if the rules often favored the strong.

Carney says that the deal has broken down. Economic integration is no longer just about working together; it is now used to gain power. Tariffs, financial systems, and supply chains are often used as weapons. The connections that once brought wealth now make countries more vulnerable.

This pattern is not just found in geopolitics. It also appears in today’s platform economy. The way power works in both areas shows that integration is often used to gain an advantage over others.

Digital Feudalism and the Rituals of Compliance

At first, platforms like Amazon offered small and mid-sized businesses clear benefits: they brought buyers together, handled shipping and payments, and built trust. Like American leadership in the late twentieth century, these platforms offered real public goods. It made sense to join them, and for many, it still does.

But over time, many sellers have noticed some troubling changes. The rules are unclear and can change suddenly. The platform does not treat everyone the same. It even competes with its own suppliers. Profits decline as dependence on the platform grows. It is also hard to leave, since doing so can mean losing brand visibility and customer data. These quiet trade-offs show how much power platforms have, and explain why many sellers stay even when profits fall.

And yet, most sellers comply.

They adjust to changing algorithms, pay new fees, and accept being removed from the platform without warning. They may praise the platform in public but feel frustrated in private. Leaving seems impossible, and speaking out feels risky.

Carney, using Václav Havel’s idea, would see this behavior right away. Havel called it “living within the lie”: acting as if you believe in a system you know is not true, kept going not just by force but by repeated acts of compliance.

In geopolitics, the false belief was that rules limited the actions of powerful countries. In digital markets, the false belief is that platforms are neutral, fair, and treat everyone equally.

Asymmetric Power in Integrated Systems

What these situations have in common is not their ideas, but how they are set up.

In highly integrated systems:

- Exit is costly.

- Rules are set unilaterally.

- Enforcement is discretionary.

- Participants negotiate individually with a dominant center.

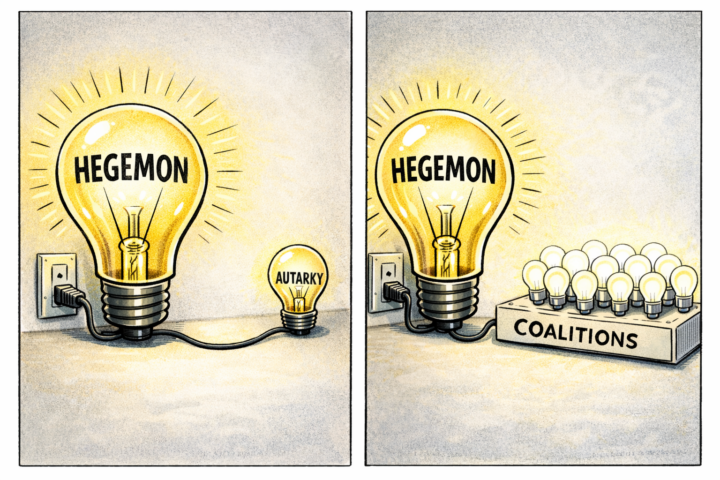

Power comes not just from being big, but from making others feel they have no choice but to take part. This is why Carney’s warning to middle powers, “If you’re not at the table, you’re on the menu,” fits platform economies so well. One country alone has little power against a dominant one, just as one seller has little power against a huge platform. Even many sellers, acting alone, are still weak.

When others are divided, it helps those in power the most.

Strategic Autonomy Without Isolation

Carney warns against the wrong answer: cutting yourself off from others. Trying to be completely self-sufficient, whether as a country or a business, is expensive and fragile. The real solution is not to leave these systems, but to limit the power they give to a few.

For countries, this means spreading out risks, agreeing on common rules, and working together to be stronger. For businesses under big platforms, the steps are much the same:

- Multi-channel sales rather than single-platform dependence

- Direct customer relationships

- Shared logistics and payment infrastructure

- Collective bargaining and standards-setting among suppliers

The aim is not to run away, but to have more choices. It’s not about being perfect, but about having more power to negotiate.

The Fragility of Legitimacy

One of Carney’s key points is that power based on routine compliance is actually weak. Those in charge last not because there are no other options, but because it seems impossible for others to work together.

That perception can change.

Middle powers do not overcome stronger ones just by fighting. They do it by telling the truth, refusing to give respect to those who don’t deserve it, reducing their dependence, and working together. The same is true for digital platforms. Their power comes not just from technology or size, but from the shared belief, rarely questioned, that there is no other way.

When people stop believing there are no alternatives, new systems become possible.

Taking the Sign Out of the Window

When Carney says to “take the sign out of the window,” he is really asking for honesty: to stop pretending to support systems that no longer work, and to start creating ones that do.

In geopolitics, this means admitting the old system is over and acting in line with that reality. In the digital world, it means seeing that platform neutrality is a myth, and responding not with longing for the past or anger, but by working together, being practical, and building new ways to organize.

The old deals are finished. Now, both countries and companies must decide: will we keep pretending, or will we finally start building something real?

**Canadian Prime MInister Mark Carney’s Davos 2026 Speech

Thank you, Larry.

It’s a pleasure – and a duty – to be with you at this turning point for Canada and for the world.

Today, I’ll talk about the rupture in the world order, the end of a nice story, and the beginning of a brutal reality where geopolitics among the great powers is not subject to any constraints.

But I also submit to you that other countries, particularly middle powers like Canada, are not powerless. They have the capacity to build a new order that embodies our values, like respect for human rights, sustainable development, solidarity, sovereignty, and territorial integrity of states.

The power of the less powerful begins with honesty.

Every day we are reminded that we live in an era of great power rivalry. That the rules-based order is fading. That the strong do what they can, and the weak suffer what they must.

This aphorism of Thucydides is presented as inevitable – the natural logic of international relations reasserting itself. And faced with this logic, there is a strong tendency for countries to go along to get along. To accommodate. To avoid trouble. To hope that compliance will buy safety.

It won’t.

So, what are our options?

In 1978, the Czech dissident Václav Havel wrote an essay called The Power of the Powerless. In it, he asked a simple question: how did the communist system sustain itself?

His answer began with a greengrocer. Every morning, this shopkeeper places a sign in his window: “Workers of the world, unite!” He does not believe it. No one believes it. But he places the sign anyway – to avoid trouble, to signal compliance, to get along. And because every shopkeeper on every street does the same, the system persists.

Not through violence alone, but through the participation of ordinary people in rituals they privately know to be false.

Havel called this “living within a lie.” The system’s power comes not from its truth but from everyone’s willingness to perform as if it were true. And its fragility comes from the same source: when even one person stops performing — when the greengrocer removes his sign — the illusion begins to crack.

It is time for companies and countries to take their signs down.

For decades, countries like Canada prospered under what we called the rules-based international order. We joined its institutions, praised its principles, and benefited from its predictability. We could pursue values-based foreign policies under its protection.

We knew the story of the international rules-based order was partially false. That the strongest would exempt themselves when convenient. That trade rules were enforced asymmetrically. And that international law applied with varying rigour depending on the identity of the accused or the victim.

This fiction was useful, and American hegemony, in particular, helped provide public goods: open sea lanes, a stable financial system, collective security, and support for frameworks for resolving disputes.

So, we placed the sign in the window. We participated in the rituals. And largely avoided calling out the gaps between rhetoric and reality.

This bargain no longer works.

Let me be direct: we are in the midst of a rupture, not a transition.

Over the past two decades, a series of crises in finance, health, energy, and geopolitics laid bare the risks of extreme global integration.

More recently, great powers began using economic integration as weapons. Tariffs as leverage. Financial infrastructure as coercion. Supply chains as vulnerabilities to be exploited.

You cannot “live within the lie” of mutual benefit through integration when integration becomes the source of your subordination.

The multilateral institutions on which middle powers relied— the WTO, the UN, the COP – the architecture of collective problem solving – are greatly diminished.

As a result, many countries are drawing the same conclusions. They must develop greater strategic autonomy: in energy, food, critical minerals, in finance, and supply chains.

This impulse is understandable. A country that cannot feed itself, fuel itself, or defend itself has few options. When the rules no longer protect you, you must protect yourself.

But let us be clear-eyed about where this leads. A world of fortresses will be poorer, more fragile, and less sustainable. And there is another truth: if great powers abandon even the pretence of rules and values for the unhindered pursuit of their power and interests, the gains from “transactionalism” become harder to replicate. Hegemons cannot continually monetize their relationships.

Allies will diversify to hedge against uncertainty. Buy insurance. Increase options. This rebuilds sovereignty – sovereignty that was once grounded in rules, but will be increasingly anchored in the ability to withstand pressure.

As I said, such classic risk management comes at a price, but that cost of strategic autonomy, of sovereignty, can also be shared. Collective investments in resilience are cheaper than everyone building their own fortress. Shared standards reduce fragmentation. Complementarities are positive sum.

The question for middle powers, like Canada, is not whether to adapt to this new reality. We must. The question is whether we adapt by simply building higher walls – or whether we can do something more ambitious.

Canada was amongst the first to hear the wake-up call, leading us to fundamentally shift our strategic posture.

Canadians know that our old, comfortable assumption that our geography and alliance memberships automatically conferred prosperity and security is no longer valid.

Our new approach rests on what Alexander Stubb has termed “values-based realism” – or, to put it another way, we aim to be principled and pragmatic.

Principled in our commitment to fundamental values: sovereignty and territorial integrity, the prohibition of the use of force except when consistent with the UN Charter, respect for human rights.

Pragmatic in recognising that progress is often incremental, that interests diverge, that not every partner shares our values. We are engaging broadly, strategically, with open eyes. We actively take on the world as it is, not wait for a world we wish to be.

Canada is calibrating our relationships so their depth reflects our values. We are prioritising broad engagement to maximise our influence, given the fluidity of the world order, the risks that this poses, and the stakes for what comes next.

We are no longer relying on just the strength of our values, but also on the value of our strength.

We are building that strength at home.

Since my government took office, we have cut taxes on incomes, capital gains and business investment, we have removed all federal barriers to interprovincial trade, and we are fast-tracking a trillion dollars of investment in energy, AI, critical minerals, new trade corridors, and beyond.

We are doubling our defence spending by 2030 and are doing so in ways that builds our domestic industries.

We are rapidly diversifying abroad. We have agreed a comprehensive strategic partnership with the European Union, including joining SAFE, Europe’s defence procurement arrangements.

We have signed twelve other trade and security deals on four continents in the last six months.

In the past few days, we have concluded new strategic partnerships with China and Qatar.

We are negotiating free trade pacts with India, ASEAN, Thailand, Philippines, Mercosur.

To help solve global problems, we are pursuing variable geometry— different coalitions for different issues, based on values and interests.

On Ukraine, we are a core member of the Coalition of the Willing and one of the largest per-capita contributors to its defence and security.

On Arctic sovereignty, we stand firmly with Greenland and Denmark and fully support their unique right to determine Greenland’s future.

Our commitment to Article 5 is unwavering. We are working with our NATO allies (including the Nordic Baltic 8) to further secure the alliance’s northern and western flanks, including through Canada’s unprecedented investments in over-the-horizon radar, submarines, aircraft, and boots on the ground. Canada strongly opposes tariffs over Greenland and calls for focused talks to achieve shared objectives of security and prosperity for the Arctic.

On plurilateral trade, we are championing efforts to build a bridge between the Trans-Pacific Partnership and the European Union, creating a new trading block of 1.5 billion people. On critical minerals, we are forming buyer’s clubs anchored in the G7 so that the world can diversify away from concentrated supply. On AI, we are cooperating with like-minded democracies to ensure we will not ultimately be forced to choose between hegemons and hyperscalers.

This is not naive multilateralism. Nor is it relying on diminished institutions. It is building the coalitions that work, issue by issue, with partners who share enough common ground to act together.

In some cases, this will be the vast majority of nations. And it is creating a dense web of connections across trade, investment, culture on which we can draw for future challenges and opportunities.

Middle powers must act together because if you are not at the table, you are on the menu.

Great powers can afford to go it alone. They have the market size, the military capacity, the leverage to dictate terms. Middle powers do not.

But when we only negotiate bilaterally with a hegemon, we negotiate from weakness. We accept what is offered. We compete with each other to be the most accommodating. T

his is not sovereignty. It is the performance of sovereignty while accepting subordination. In a world of great power rivalry, the countries in between have a choice: to compete with each other for favour or to combine to create a third path with impact.

We should not allow the rise of hard power to blind us to the fact that the power of legitimacy, integrity, and rules will remain strong — if we choose to wield it together. Which brings me back to Havel.

What would it mean for middle powers to “live in truth”? It means naming reality. Stop invoking the “rules-based international order” as though it still functions as advertised. Call the system what it is: a period of intensifying great power rivalry, where the most powerful pursue their interests using economic integration as a weapon of coercion.

It means acting consistently. Apply the same standards to allies and rivals. When middle powers criticise economic intimidation from one direction but stay silent when it comes from another, we are keeping the sign in the window. It means building what we claim to believe in. Rather than waiting for the old order to be restored, create institutions and agreements that function as described. And it means reducing the leverage that enables coercion.

Building a strong domestic economy should always be every government’s priority. Diversification internationally is not just economic prudence; it is the material foundation for honest foreign policy. Countries earn the right to principled stands by reducing their vulnerability to retaliation.

Canada has what the world wants. We are an energy superpower. We hold vast reserves of critical minerals. We have the most educated population in the world. Our pension funds are amongst the world’s largest and most sophisticated investors. We have capital, talent, and a government with the immense fiscal capacity to act decisively. And we have the values to which many others aspire.

Canada is a pluralistic society that works. Our public square is loud, diverse, and free.

Canadians remain committed to sustainability. We are a stable, reliable partner—in a world that is anything but—a partner that builds and values relationships for the long term.

Canada has something else: a recognition of what is happening and a determination to act accordingly. We understand that this rupture calls for more than adaptation. It calls for honesty about the world as it is. We are taking the sign out of the window. The old order is not coming back.

We should not mourn it. Nostalgia is not a strategy. But from the fracture, we can build something better, stronger, and more just. This is the task of the middle powers, who have the most to lose from a world of fortresses and the most to gain from a world of genuine cooperation.

The powerful have their power. But we have something too – the capacity to stop pretending, to name reality, to build our strength at home, and to act together. That is Canada’s path. We choose it openly and confidently. And it is a path wide open to any country willing to take it with us.

Author’s Note: Assist by ChatGPT and Grammarly